The Unitarian Universalist Service Committee advances human rights through grassroots collaborations.

What Would You Do With $8.5 Trillion?

By Josh Leach and Nafisa Abdinoor on September 6, 2024

Medicare-for-all, housing, universal basic income and a Green New Deal…whenever progressive social reforms like these are discussed, people often say: “that sounds great in theory—but how are you gonna pay for it?”

With the U.S. government routinely running annual deficits in excess of $1 trillion, expensive programs like these can seem out of reach. Even if these reforms would be for the public good, then—the argument often runs—we simply don’t have the money to afford them.

But what if the size of those annual deficits actually pales in comparison to the existing untaxed wealth of America’s billionaires? One trillion may sound like a lot, after all—but it turns out that the country’s wealthiest citizens are taking home an even more mind-boggling amount of money in the form of unrealized capital gains. And, unlike the wages and salaries that people earn for work, these gains are completely untaxed—unless they are reduced to cash.

We’re not taxing how much, did you say?

Just how much money are we talking about here? UUSC’s research team ran the numbers. According to reporting earlier this year, no less than $48 trillion of wealth in the U.S. is parked in unrealized capital gains.

No, you didn’t read that wrong—that’s trillion with a “t.” And again, because these gains are unrealized, every cent of this money is currently untaxed.

Added up, this untaxed wealth eclipses the size of the government’s existing financial obligations. The entire U.S. National Debt currently sits at $35 trillion. The astronomical scale of this burden has produced sighs and hand-wringing from fiscal hawks for decades. But, as we just saw, U.S. taxpayers are already sitting on even more than this amount in untaxed wealth.

Of course, not all of this money is held by the ultra-rich. Many ordinary people have untaxed capital gains too, in their retirement or investment accounts. But even if we look only at the unrealized capital gains of the country’s billionaires and centi-millionaires (that is, people with more than $100 million in wealth)—we still find $8.5 trillion that is never taxed. And if we consider the entire top 1% of the country, they are sitting on more than $21 trillion in unrealized gains.

This obscene disproportion in the country’s untaxed wealth also reflects the long history of systemic racism in U.S. society. According to UUSC’s findings, white households currently have 600% the amount of unrealized capital gains as Black and Hispanic households—a glaring illustration of the country’s deep racial wealth divide.

Why tax work more than wealth?

Most people’s intuitive sense of fairness tells them that if people are taxed for the effort they put in at a job, billionaires should pay their fair share too for wealth accruals for which they performed no labor. “Tax wealth the way we tax work” makes sense as a rallying cry to most of us—especially when we consider how much more most people pay for the money earned from labor than billionaires will ever pay for the effortless gains of capital appreciation.

In case you’re wondering just how big this disparity is, UUSC’s researchers ran the numbers on this too. As many of us know, the current highest tax bracket under federal law is 37% of annual income. One would assume, therefore, that this is how much the country’s richest people pay each year—right?

Wrong! It turns out, when unrealized capital gains are taken into account, the country’s billionaires pay an effective tax rate of only 4.8%. That’s not only far below the highest tax bracket—it’s also well below what most middle-income families pay each year from the proceeds of their own labor.

How could we put that money to work for communities?

Taxing even a fraction of these unrealized gains would transform the nation’s fiscal outlook. Progressive social reforms that are so often characterized as pipe dreams would suddenly become affordable and realistic.

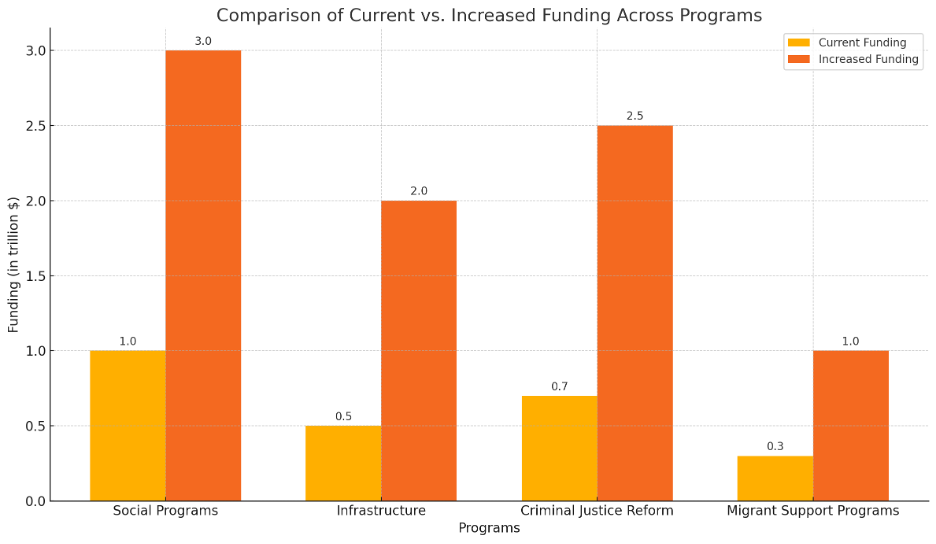

UUSC’s researchers laid out some of many ways this untaxed largesse could be put to better use. If the current $8.5 trillion in the mega-wealthy’s unrealized gains were spent in the public interest, the federal government could triple its current spending on social programs, quadruple its funding for infrastructure, provide three times the amount of funding for programs to support people in migration—and this is only a start.

So often, we are inclined to throw up our hands in the face of society’s challenges. Global crises like climate change, the displacement of refugees, poverty and inequality, racial injustice and police violence, seem so vast and entrenched that it must be beyond our nation’s fiscal capacity to respond…

Yet, UUSC’s research reveals that the problem is not a lack of resources. The country has wealth enough to answer these challenges many times over. The question is simply: how should this untaxed money be used? To line someone’s pocket and generate more passive income? Or, to ensure basic human rights, including shelter and a liveable climate?

Is humanity better off when a billionaire pays a lower effective tax rate than a nurse or a firefighter? Or, would we not all benefit together from the ultra-wealthy paying their fair share to address our planet’s most glaring collective challenges? The choice is ours to make.

Image credit: Shutterstock (Juicy FOTO)